23 rows Tax Relief Year 2018. When you file your income tax this 2019 make sure to have a good hard look at your expenditure from the year before so you dont miss out on any tax relief you can claim for.

The Purpose And History Of Income Taxes St Louis Fed

Income Tax Table 2018 Malaysia masuzi December 12 2018 Uncategorized Leave a comment 21 Views Individual income tax in malaysia for audit tax accountancy in.

. While the 28 tax rate for non-residents is a 3 increase from the previous years. 20182019 Malaysian Tax Booklet Personal Income Tax. Malaysia Personal Income Tax Rate.

20182019 Malaysian Tax Booklet. Individual Life Cycle. Now that youre up to speed on whether youre eligible for taxes and how the tax rates work lets get down to the business of.

Tax Rate Table 2018 Malaysia masuzi December 14 2018 Uncategorized Leave a comment 0 Views Income tax how to calculate bonus and personal tax archives updates. The relevant proposals from an individual income tax Malaysia 2018 perspective are summarized below. Malaysia personal income tax guide 2019.

A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a. On the First 5000. Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except.

Introduction Individual Income Tax. Calculations RM Rate TaxRM 0 - 5000. To increase the disposable income of middle-income taxpayers and address the rising cost of living the 2018 budget.

The amount of tax relief 2018 is determined according to governments. Assessment Year 2018-2019 Chargeable Income. The following rates are applicable to resident individual taxpayers for YA 2021 and 2022.

A non-resident individual is taxed at a flat rate of. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. Technical or management service fees are only liable to tax if the services are rendered in Malaysia.

The 2018 national budget was announced by Malaysias Minister of Finance on 27 October 2017. This means that low-income earners are imposed with a lower tax rate. The relevant proposals from an individual tax perspective are summarized below.

Monthly Income Tax Table 2018 Malaysia. Masuzi December 13 2018 Uncategorized Leave a comment 3 Views. 12 rows Nonresident individuals are taxed at a flat rate of 28.

Tax relief refers to a reduction in the amount of tax an individual or company has to pay. Reduction of certain individual income tax rates. The income tax filing process in Malaysia.

Personal income tax rates.

10 Things To Know For Filing Income Tax In 2019 Mypf My

Form 1040 U S Individual Income Tax Return 2018

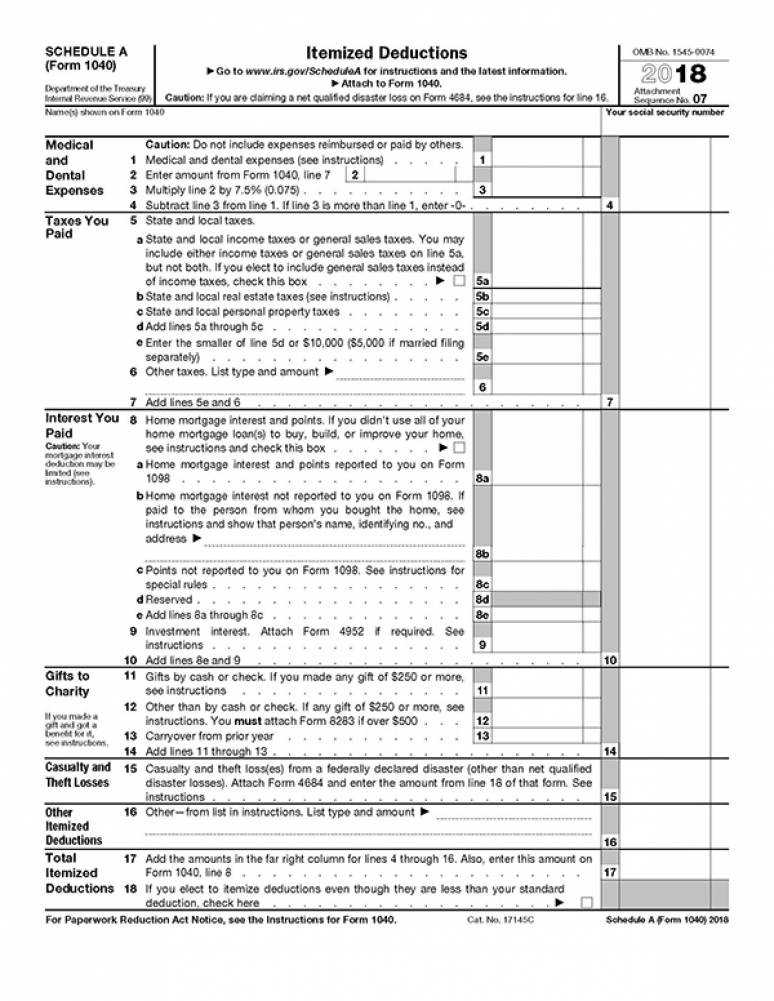

Taxable Income Formula Examples How To Calculate Taxable Income

Effective Tax Rate Formula Calculator Excel Template

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018

Why It Matters In Paying Taxes Doing Business World Bank Group

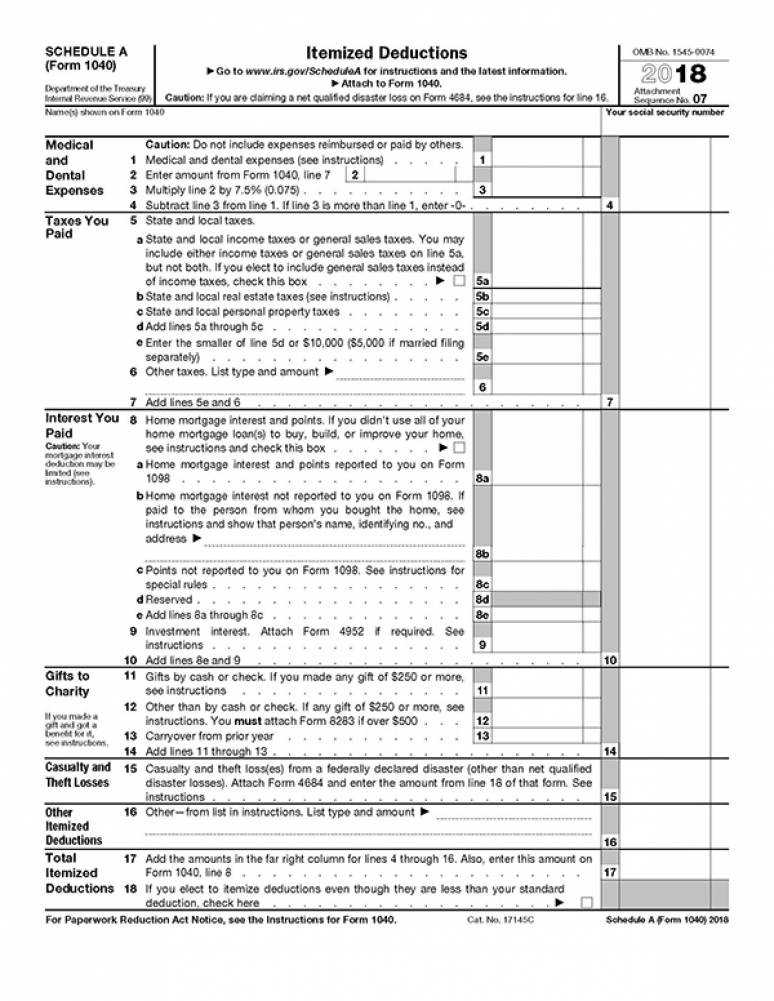

2018 Irs Tax Forms 1040 Schedule A Itemized Deductions U S Government Bookstore

Cash Flow Projection Worksheet

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Formula For Calculating Net Present Value Npv In Excel

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Provision For Income Tax Definition Formula Calculation Examples

Taxable Income Formula Examples How To Calculate Taxable Income

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

India Taxes On Exports Of Tax Revenue 2022 Data 2023 Forecast 1974 2018 Historical

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

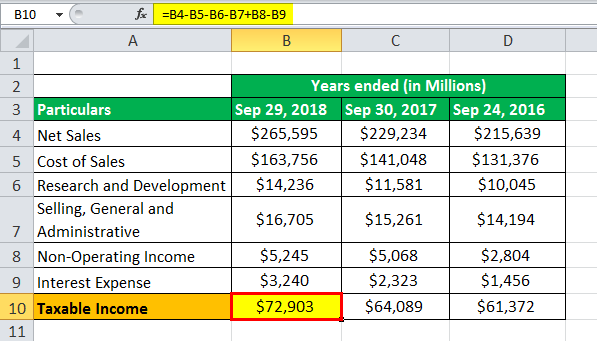

America S 1 Has Taken 50 Trillion From The Bottom 90 Time